Essential Series: Durable Powers of Attorney (Part I)

Estate planning is not just about what to do with your stuff after you die. That’s partly true, but it’s not the whole picture. There are two times in your life cycle that we look at for estate planning, while you are alive but incapacitated, and after you die. It’s the first one that we’re looking at today with the durable financial power of attorney.

Incapacitated means you legally cannot make certain decisions for yourself. It happens. Imagine that you are in a car accident and slip into a coma when you get to the hospital. Or perhaps you develop early onset dementia. In either scenario, you’re going to need someone to manage your assets and finances on your behalf when you are incapacitated. If you’ve done your planning, you’ll have in place a durable financial power of attorney.

A “Durable Financial Power of Attorney”, or DPOA is a form of power of attorney that authorizes someone to step in your shoes to manage your finances and assets. “Durable” means it is effective while you are incapacitated. In a DPOA, if it’s your assets that are going to be managed by someone else, then you’re the principal, and the someone else is an “Attorney-in-Fact”. An Attorney-in-Fact is a fiduciary, meaning they need to act on your behalf even if doing so is against their own interests.

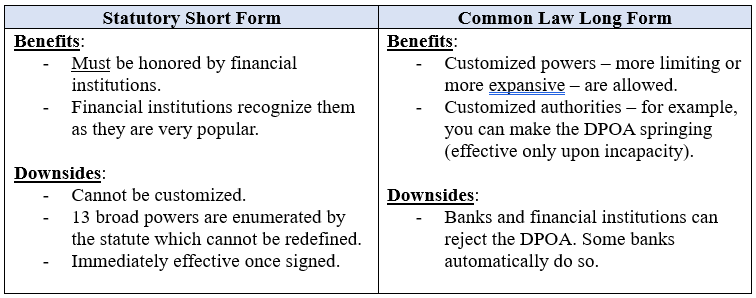

In Minnesota there are two types of DPOAs: the Statutory Short Form Power of Attorney, and the Common Law Long Form Power of Attorney.

WARNING. The DPOA is an incredibly powerful document, that if misused, could be devastating to you. If you appointed an Attorney-in-Fact that is not trustworthy and cleans out your bank and retirement accounts, yes, they’d get in a lot of trouble (and be subject to treble damages), but good luck on getting your stuff back.

That said, don’t shy away from setting up a valid DPOA! Doing so is inexpensive and easy. If you do not have one in place and you become incapacitated, it’ll cost thousands of dollars and months of time to get in place a conservator through the courts.

If you have questions about Durable Financial Powers of Attorney, please feel free to reach out to us for a free consultation!